Your AI Transformation Checklist for Risk Engineering

In a year marred by crisis and uncertainty, even a mature industry such as property & casualty (P&C) insurance has reached a pivotal crossroads. According to the Insurance Information Institute, insured losses from natural catastrophes in 2019 totaled $71 billion. That number is only expected to rise in 2020 with the onslaught of hurricanes and wildfires hammering the United States.

Insurers must contend with a rapidly changing risk landscape. Falling interest rates, climate change, man-made risks and civil unrest are causing unprecedented destruction and business interruption. This is exacerbated by the COVID-19 pandemic, cyber security threats, and terrorism, causing claims to skyrocket.

One saving grace is the global movement towards digital transformation and automation including the adoption of artificial intelligence (AI). Changing client expectations have propelled organizations to rethink age-old processes, and ways of conducting business.

If you’re wondering whether an AI solution is right for your risk engineering firm or department, Orbiseed offers a simple checklist to help validate whether your organization is ripe for game-changing disruption.

Before we take a deeper look at the application of AI within risk engineering, let’s define AI:

Artificial intelligence is a branch of computer science that refers to the simulation of human intelligence in machines.

Most AI examples that you hear about today – from chess-playing computers to self-driving cars – rely heavily on deep learning and natural language processing. Using these technologies, computers can be trained to accomplish specific tasks by processing large amounts of data and recognizing patterns within the data.

AI cannot however take away from the human role of decision-maker. It can simply aggregate and extract information hundreds of times faster than humans allowing the user to verify information rather than engage in the error-prone, mind-numbing task of synthesizing disparate sources of siloed and unstructured data!

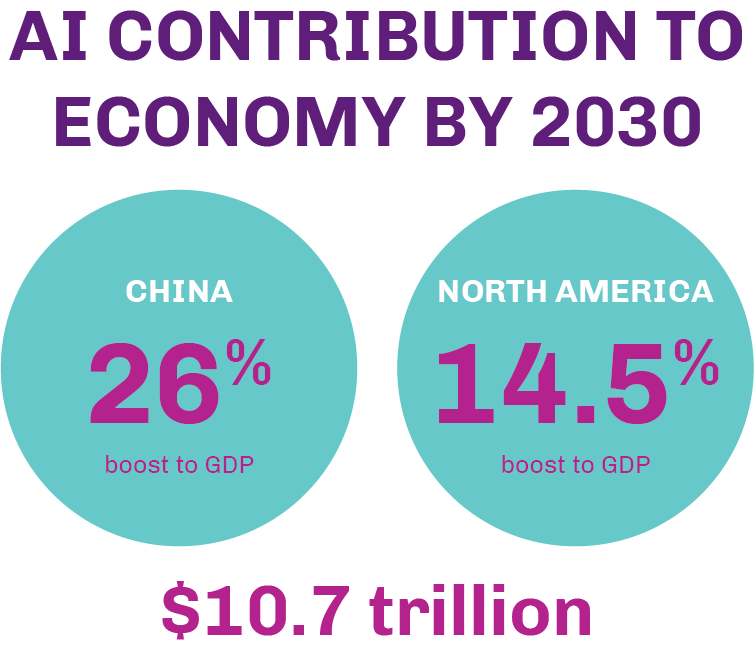

An Artificial Intelligence Study by PwC observed, “AI could contribute to the global economy by 2030, more than the current output of China and India combined.” The same report estimated $6.6 trillion would likely come from increased productivity alone. AI is likely to boost the GDP for North America by 14.5% and the GDP in China by 26%. That’s equivalent to a total of $10.7 trillion and would account for almost 70% of the global economic impact.

As mature industries such as banking, healthcare and insurance make the pioneering leap towards adopting AI, it is no secret the rewards far outweigh the risks: new-found cost efficiencies, increased revenue, improved risk management and increased customer satisfaction make up a long list of drivers attracting the C-suite to this new frontier.

So, how do you know if you’re ready to embrace AI and what are some of the areas it could improve within risk engineering?

The easiest way to get started, is to contemplate your market in five years’ time and consider what capabilities you will need to compete? - McKinsey

Align Business and AI Goals

A certain appetite and readiness for change is required on the part of the C-Suite and by the risk engineers within your workforce. A real pain point must be met, and the implementation of AI must align with the overarching business goals of your organization. For risk engineering, the time is ripe for AI disruption. According to McKinsey, “Efficiency improvement is an imperative. The industry’s current trajectory is inefficient and unsustainable, creating the conditions for disruption. This would involve digital technologies, automation, and data and analytics to not only reduce error-prone manual processes but also enable an agile way of working.”

If account engineers and risk engineering consultants spent more of their time on risk verification and selection rather than aggregation and analysis, this would help underwriters speed up the time to assess and quote on a new bid, and ultimately increase the chances of winning new business. Statistically, the first response to a submission wins over 50% of the time and new customers mean an increase in gross written premiums.

Still, the question remains, whether your organization wants to be an early adopter, fast follower or follower? Will the AI solution you create in-house or via a third-party vendor disrupt the sector and provide you with a competitive edge?

Examine Internal Talent. Find Your AI Champions.

Another critical factor is talent. Are there champions within your company willing to take on the added time it requires to inform the user journey and customizations, perhaps even label the initial data and to ultimately execute on the AI opportunity at hand? It is vital there is a top-down, and equally, a bottom-up culture of adoption for AI implementation to succeed.

A global digital practice survey revealed insurance companies are attracting less digital talent than other financial services companies such as fintech and asset management. In a recent survey, 80% of millennials said they have limited knowledge of the insurance industry, and 44% said careers in insurance sound “boring.” An interview with a veteran risk engineer also revealed the majority of senior risk engineers are close to retirement and may be resistant to employing new technologies. “Indeed, perception can shape reality, and the current reality is that the insurance industry isn’t viewed as relevant or exciting to up-and-coming digitally savvy workers,” concluded the report.

Partner with AI Vendors You Trust to Scale Quickly.

An AI firm should know your industry inside and out, have secure networks to help protect your data and enable you to scale your AI program fast. You will also need to consider whether to select AI integrations over ground-up builds. This will vastly reduce the time it takes to output a working model for your business. A good software integration will also layer into the existing system you have rather than force your employees to learn an entirely new system.

Assess your team’s readiness before engaging in an AI initiative by taking this short quiz:

The AI Checklist

Find out how Orbiseed’s artificial intelligence and natural language processing solution for commercial property insurance can help your organization reimagine risk survey report processes. Discover how to use AI to reduce costs, sell more and manage risk better. Schedule your complimentary demo today.

Orbiseed is the only purpose-built AI solution for risk engineering firms and commercial property insurance carriers. Our technology enables you to increase business without adding personnel. We help you qualify bids and assess risk survey reports faster, affordably and with pinpoint accuracy.